Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Bright Money |

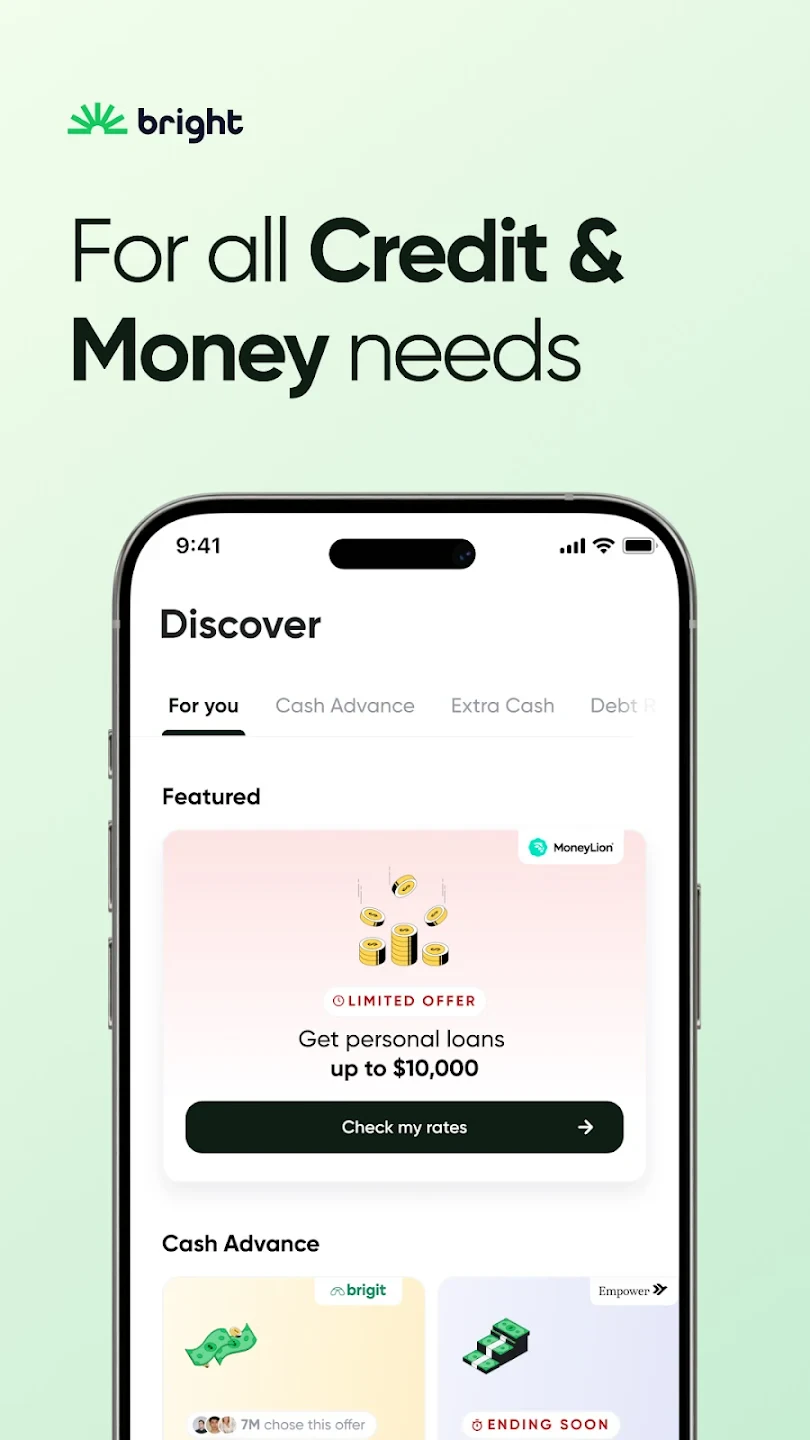

Bright Money – AI Debt Manager is a sophisticated mobile and web application designed to help individuals navigate and manage personal debt effectively using artificial intelligence. It integrates with various financial accounts to automatically categorize spending, analyze repayment strategies, and provide actionable recommendations for reducing high-interest debt. Ideal for anyone feeling overwhelmed by credit cards, personal loans, or student loans seeking a data-driven path to financial freedom.

Its core appeal lies in automating the often tedious aspects of debt tracking and strategy formulation, allowing users to focus on execution. The AI learns from user behavior and market conditions to suggest personalized, dynamic plans, making complex financial decisions simpler and more accessible for people striving to regain control of their finances through the Bright Money – AI Debt Manager.

| App Name | Highlights |

|---|---|

| YNAB (You Need A Budget) |

A highly praised budgeting tool emphasizing zero-based budgeting, where every dollar is assigned a job. Known for its robust transaction categorization, goal setting, and strong focus on user responsibility. |

| Mint by Intuit |

Part of the Intuit family (same makers as TurboTax and QuickBooks). Offers budgeting, bill payment setup, identity monitoring, and investment tracking alongside debt management features, often integrated with bank accounts. |

| Snap debt |

Known for its visually intuitive debt repayment tracker with customizable repayment plans and tools for comparing offers, often praised for its user-friendly interface specifically tailored for consolidating and paying off multiple debts. |

Q: Is the “Bright Money – AI Debt Manager” completely free to use?

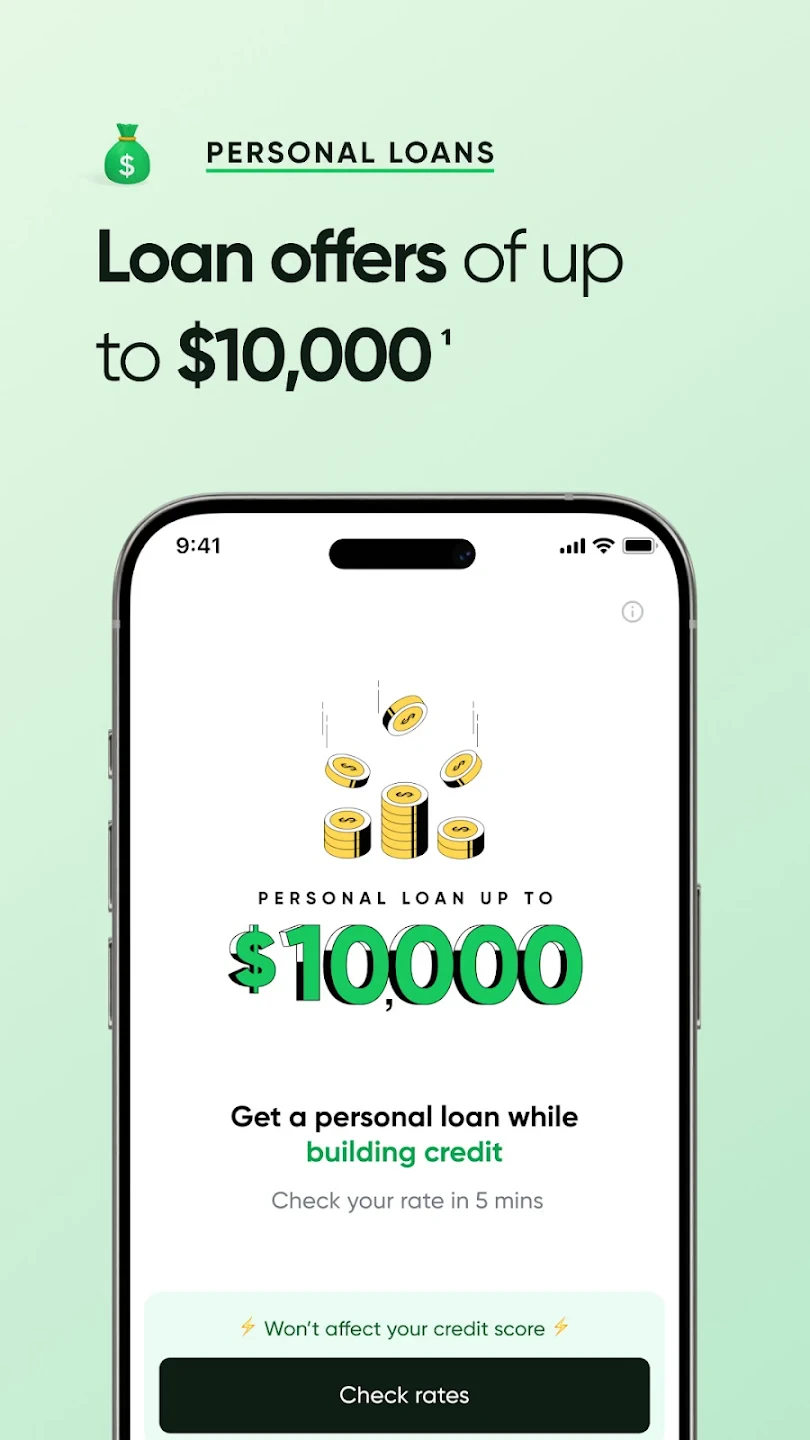

A: The app typically offers a limited free version with basic tracking and budgeting features. However, access to the full AI analysis, personalized repayment strategies, advanced budget controls, and automated bill payments usually requires a subscription plan. Check the app store or website for current pricing details.

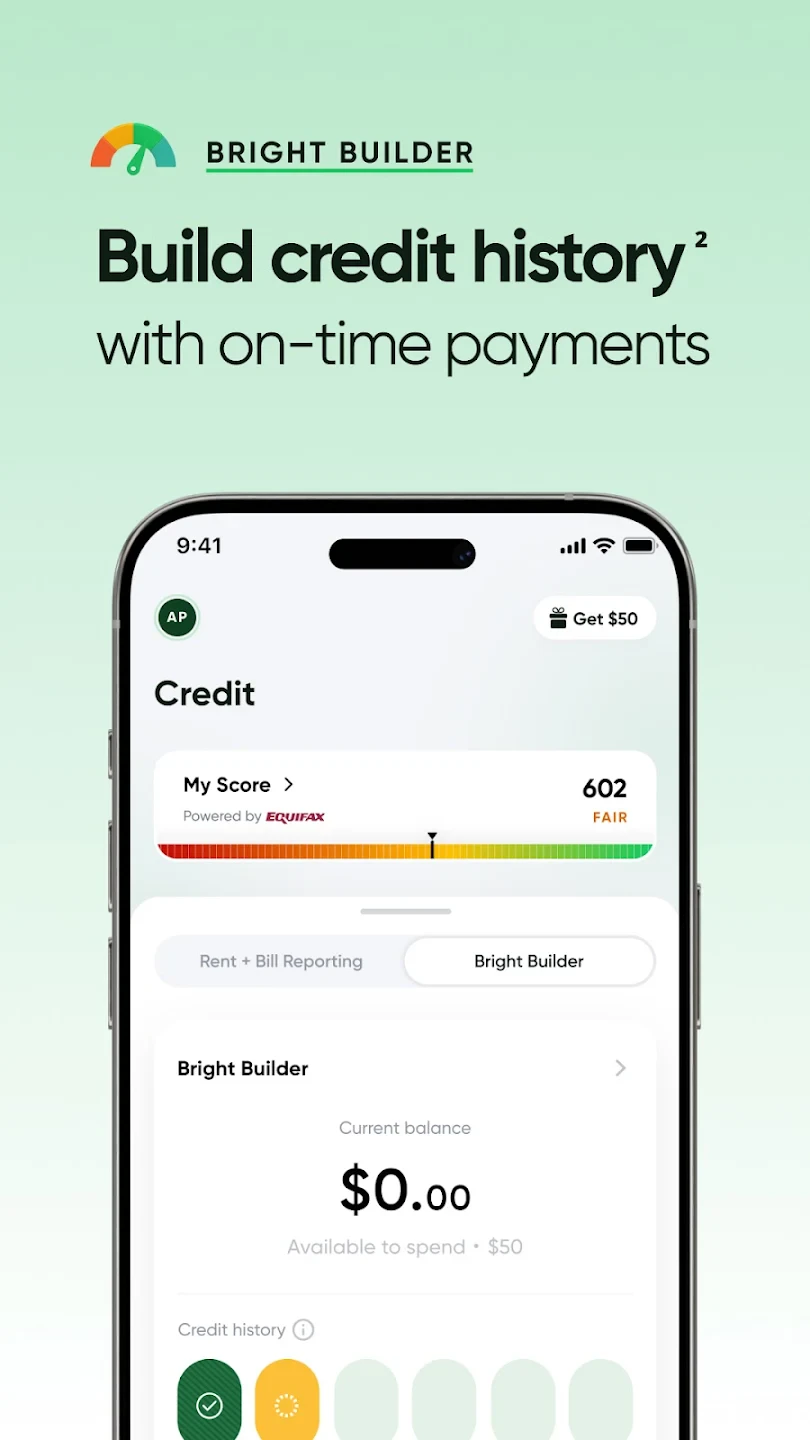

Q: How does the AI actually help with my specific debt situation?

A: The AI analyzes your financial data to understand your debt structure, spending patterns, and income. It then calculates optimal repayment sequences based on factors like interest rates and compounding effects, suggesting moves like the avalanche (lowest interest first) or snowball (smallest balance first) strategy, personalized to your goals and financial behavior.

Q: Does “Bright Money – AI Debt Manager” integrate with all my bank accounts and loan providers?

A: Bright Money strives for broad compatibility, integrating with numerous banks and financial institutions for account linking and transaction imports. However, support for niche or older financial platforms may vary. You might need manual data entry for accounts not directly supported by the app.

Q: Can I use “Bright Money – AI Debt Manager” effectively if I have a mix of different types of debt (credit cards, student loans, mortgages)?

A: Definitely. The AI is designed to handle multiple debt types simultaneously. It will assess each based on interest rate, term, and amount, then advise on how to allocate your available funds for maximum savings and fastest payoff across your entire portfolio of debt obligations.

Q: Will the app provide advice if I’m struggling to make payments?

A: Yes, the app can connect users with resources and guidance on debt negotiation, refinancing options, or payment plans. While it may not directly handle calls with creditors, it offers tools and information to effectively communicate with financial institutions and negotiate better conditions.

|

|

|

|