Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|

|

| Rating: 4.6 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Current |

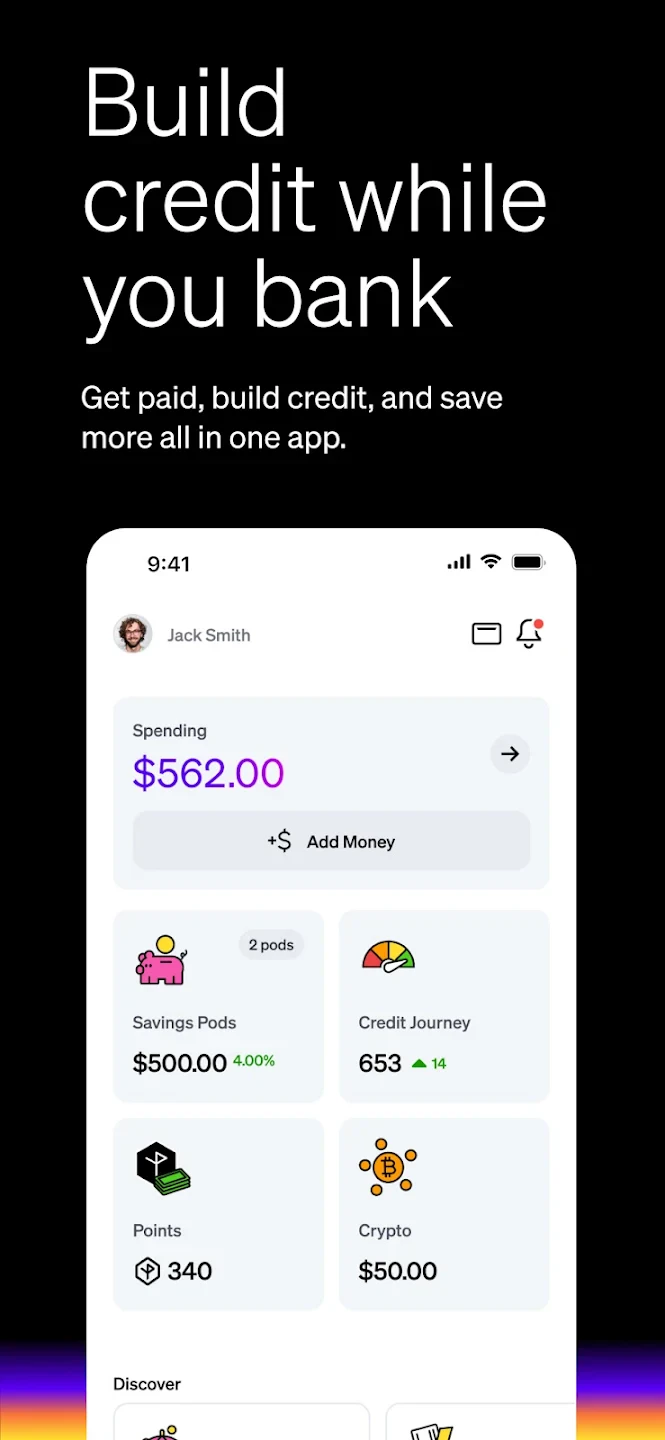

Current: The Future of Banking is a forward-thinking mobile banking application designed for young adults and digital natives. It seamlessly integrates traditional banking services with innovative features that prioritize convenience and financial education. Whether you’re a student just starting your career or a professional managing multiple accounts, this app offers a streamlined approach to financial management.

The app’s core appeal lies in its combination of robust financial tools and a sleek, intuitive interface that puts technology to work for your financial health. Current: The Future of Banking empowers users not just with transactions, but with insights and customization options that help build better financial habits. It’s specifically crafted for those who value innovation, speed, and a personalized banking experience in their daily lives.

| App Name | Highlights |

|---|---|

| N26: Thoughtful Banking |

This well-regarded app emphasizes smart budgeting tools and transparent fee structures. Known for its travel insurance options, transaction matching, and disciplined banking principles ideal for busy professionals. |

| Monzo: Financial Friend |

Developed by Revolut within the UK market, Monzo focuses on community features, shared collections, and user-friendly notifications. Includes innovative goal savings jars and detailed expense categorization. |

| Magic: Lifestyle Financing |

Strikes a unique balance between premium experiences and free features. Offers high-capitalization savings, personalized expense tracking with category goals, and flexible subscription management. |

Q: How often is the app updated with new features?

A: New features and improvements launch regularly via over-the-air updates. Current: The Future of Banking evolves quickly, with major feature cycles approximately every quarterly update, plus weekly refinements based on user feedback and technological advancements.

Q: Can I directly compare interest rates or fee transparency to traditional banks?

A: Absolutely! Our platform displays interest rates clearly upfront for all deposit products. Current: The Future of Banking maintains completely transparent fee structures with no hidden charges—everything from ATM withdrawal costs to account maintenance fees is clearly stated against each product in polished comparison tables.

Q: What mobile security measures are employed for sensitive financial actions?

A: For enhanced security, all critical financial actions require multi-factor authentication. Bio-metric authorization (Touch ID or Face ID) is used alongside transaction thresholds. Our core security infrastructure includes bi-directional encryption, real-time fraud monitoring powered by machine learning, and prompt alert notifications for unusual activities.

Q: Can blocked wire transfers be expedited for special circumstances?

A: While standard international transfers follow regulatory processing timelines, we offer a Premium Express option for an additional fee within the Send Money feature. This elevated pathway prioritizes your transaction for faster routing through our global network—ideal if you need capital to secure a deposit or time-sensitive business investment.

Q: How robust is the backup and recovery process if I lose my device or account access?

A: Current: The Future of Banking offers multiple account access recovery paths including password resets, multi-channel verification, and secure backup codes. For complete peace of mind, we maintain automatic cloud backups of all financial data, and exceptional circumstances can trigger expedited support channels for emergency account recovery needs.

|

|

|

|