Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|

|

| Rating: 4.6 | Downloads: 1,000,000+ |

| Category: Finance | Offer by: Fifth Third Bank |

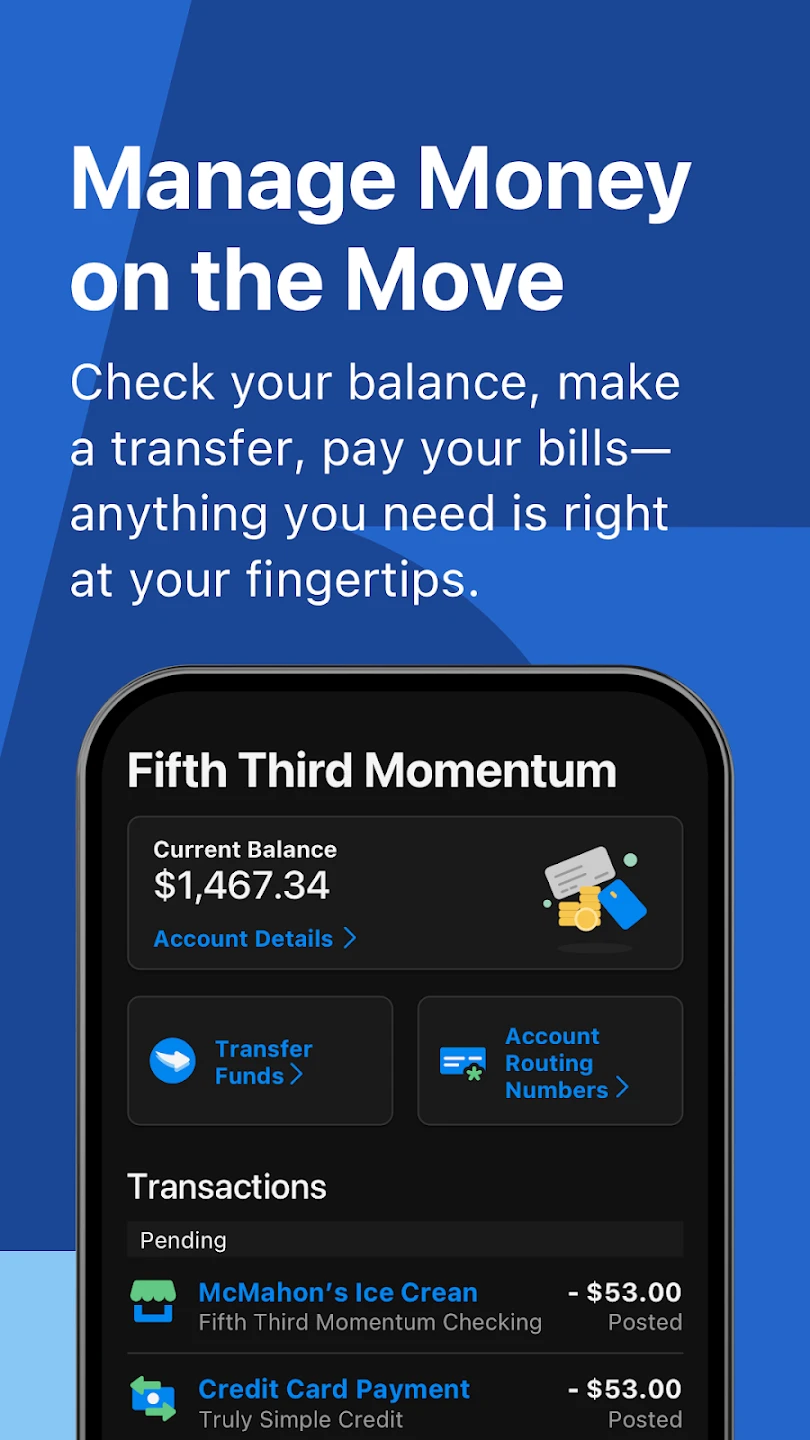

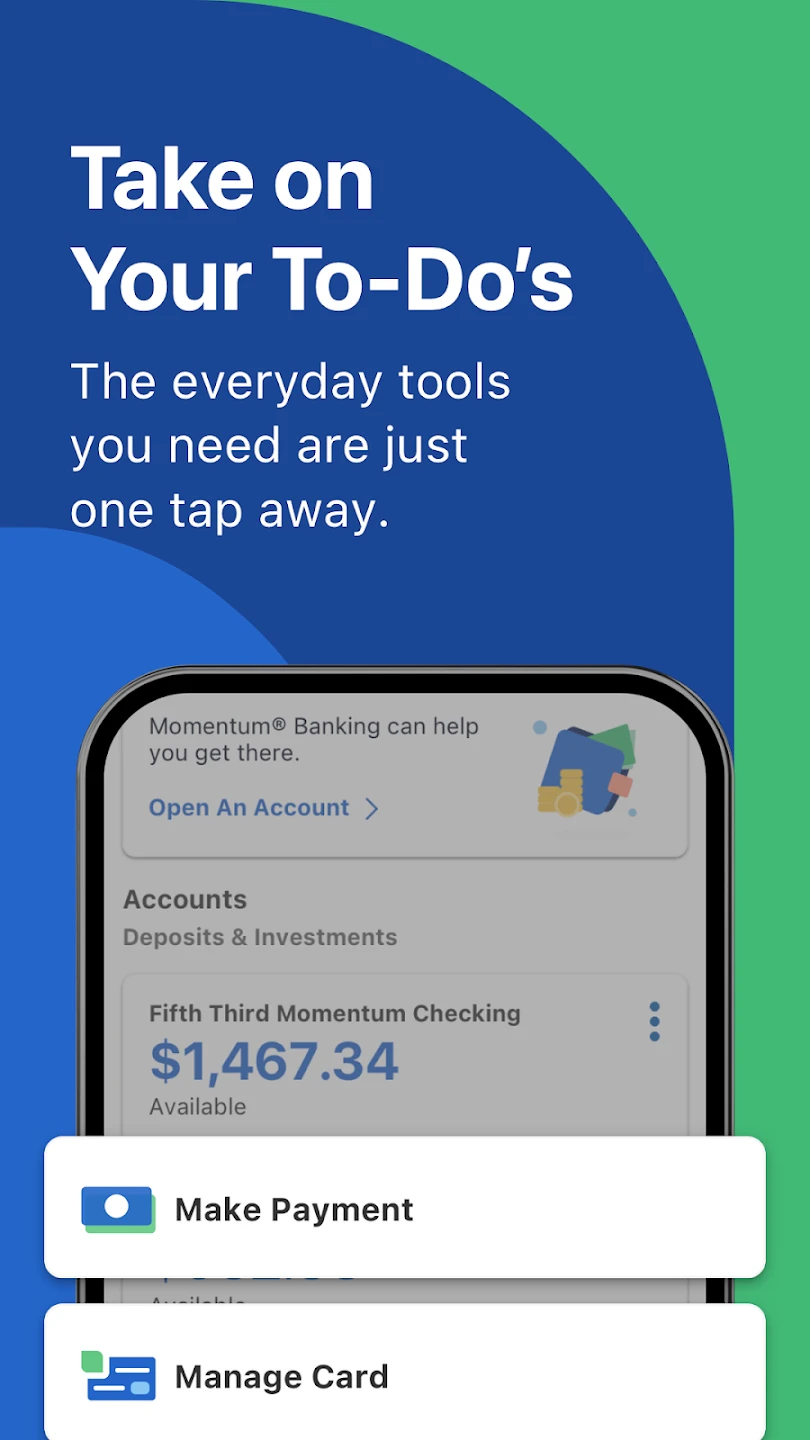

Fifth Third: 53 Mobile Banking is a dedicated mobile application designed for users of Fifth Third Financial Corporation. It allows customers to access their Fifth Third accounts, perform transactions, manage accounts, and utilize various banking services directly from their smartphones, catering specifically to members of this financial institution.

The key value of Fifth Third: 53 Mobile Banking lies in its convenience and accessibility, providing customers with a practical way to handle everyday banking tasks on-the-go. From checking balances and depositing checks to transferring funds between accounts and paying bills, this app streamlines essential banking activities, saving time for users.

| App Name | Highlights |

|---|---|

| Titan Mobile Banking |

Offers robust mobile check deposit and investment management options. Known for low transaction fees and access to unique financial products. |

| First National Direct Mobile |

Focuses on streamlined loan management and peer-to-peer transfers. Includes biometric login security and a user-friendly navigation design. |

| CapitalOne 360 App |

Provides strong AI-driven insights for spending and savings, along with versatile credit card management. Features high flexibility in account types and investment options. |

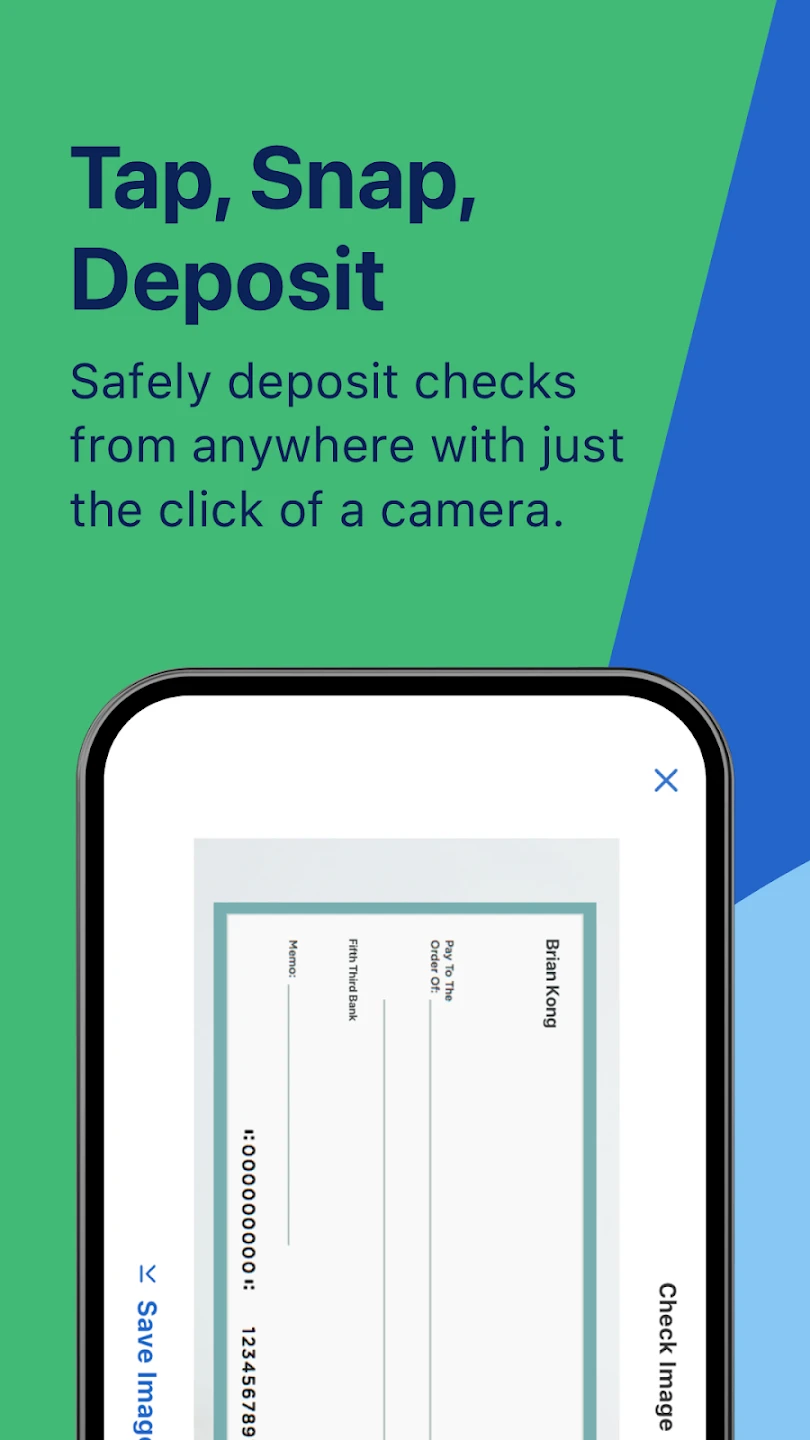

Q: Can I deposit a check using Fifth Third: 53 Mobile Banking if it’s a cashier’s check?

A: The Fifth Third: 53 Mobile Banking app’s check deposit feature is generally intended for personal checks. While it might technically allow depositing a cashier’s check by image (though not guaranteed by Fifth Third), it’s always best to verify with customer service directly for confirmation based on current Fifth Third policies.

Q: What are the security measures in place for my Fifth Third: 53 Mobile Banking app?

A: Fifth Third: 53 Mobile Banking uses multiple security layers. These include device passcodes, secure token authentication (like Touch ID or Face ID), end-to-end encryption for data transfer, and often transaction monitoring for suspicious activity, ensuring your banking information remains virtually impervious to unauthorized access.

Q: Are there any transfer limits between my Fifth Third: 53 accounts?

A: Transfer limits within Fifth Third: 53 Mobile Banking are typically determined by the type of accounts involved and the bank’s policies, but are usually quite high for standard user scenarios. You can usually find the specific daily/ monthly limits for transfers by navigating to Settings or Account Information within the app.

Q: Can I access my Fifth Third investment accounts directly through the mobile app?

A: Depending on your specific Fifth Third investment accounts, the primary mobile interface might offer basic view capabilities. For detailed trading, portfolio analysis, or executing transactions on investments, you might need to use Fifth Third’s separate Online Investing platform, which could have a distinct interface and feature set.

Q: How often are my Fifth Third: 53 account balances updated in the app?

A: Fifth Third: 53 Mobile Banking account balances are usually updated in real-time or within a few minutes for most activities like deposits and withdrawals. However, for transactions processed via Automated Clearing House (ACH), such as incoming transfers or direct deposits, full posting might take one or more business days, and reflect later in the app.

|

|

|

|