Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|

|

| Rating: 3 | Downloads: 100,000+ |

| Category: Business | Offer by: Federal Retirement Thrift Investment Board |

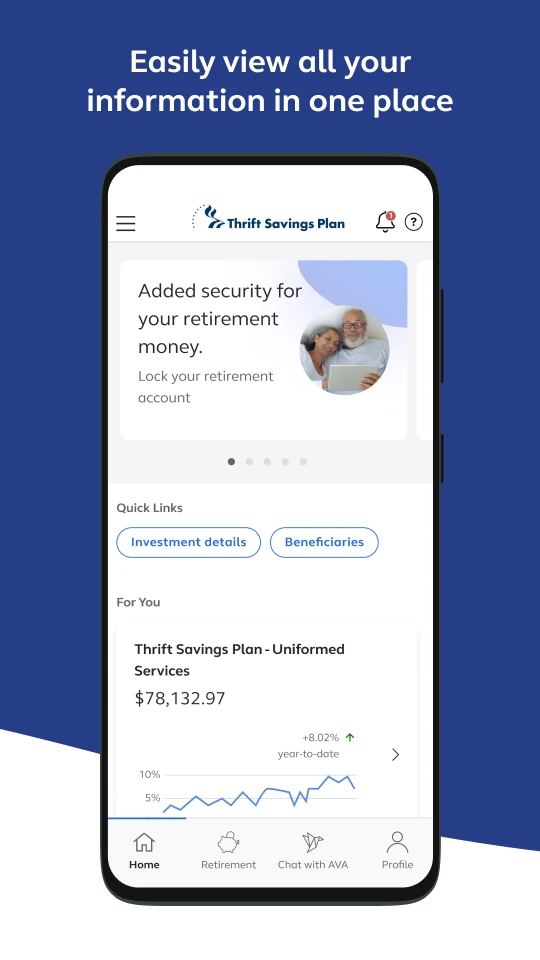

This browser-based application, known officially as the Thrift Savings Plan (TSP), is a vital financial tool for Federal employees and members of the uniformed services. It facilitates saving for retirement through tax-advantaged accounts, offering a range of government securities and investment options tailored for long-term growth. Primarily serving Federal government personnel, it streamlines the management of their retirement funds.

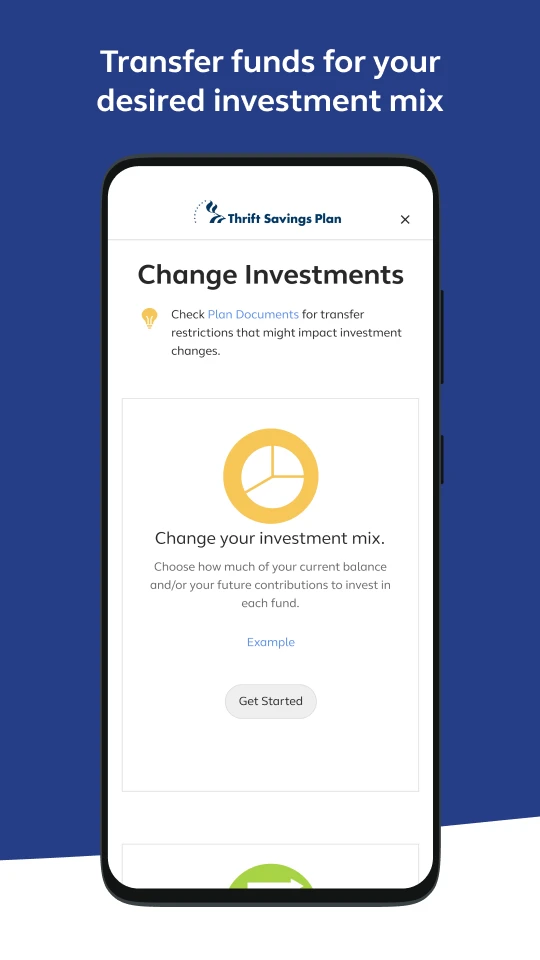

The core appeal of the Thrift Savings Plan lies in its ability to combine cost-effective government investments with convenience. By providing online account management, portfolio tracking, and loan/funding options, it empowers users to actively manage their retirement savings, fostering fiscal responsibility and significant long-term financial growth directly tied to their government employment.

| App Name | Highlights |

|---|---|

| FERS Account Portal |

Manages service retirement, disability, separation pay, and the Thrift Savings Plan for eligible Federal employees. Includes retirement benefit statements and annuity calculations. |

| Defense Finance & Supply Center (DFAS) Online |

Offers personnel finance services including TSP, FICA, DoD pay, and Thrift Store account management. Features secure transactions for payments and account inquiries. |

| General Services Administration (GSA) Schedule F |

Directly offers TSP investment options and account services, often branding them as the “GSA TSP”, though managed by Treasury. Provides competitive access similar to but distinct from direct agency portals. |

Q: Am I eligible to open a Thrift Savings Plan account?

A: Federal employees, members of the uniformed services (including military personnel), and certain family members and beneficiaries typically became eligible starting December 2, 2014. Eligibility depends on your service status and the specific rules applicable for your situation.

Q: What’s the difference between contribution and funding options?

A: Contributions are voluntary pre-tax (for tax-deferred accounts) additions to your salary, often matched by a government contribution. Funding options allow you to access loan funds or take withdrawals specifically from within your established Thrift Savings Plan.

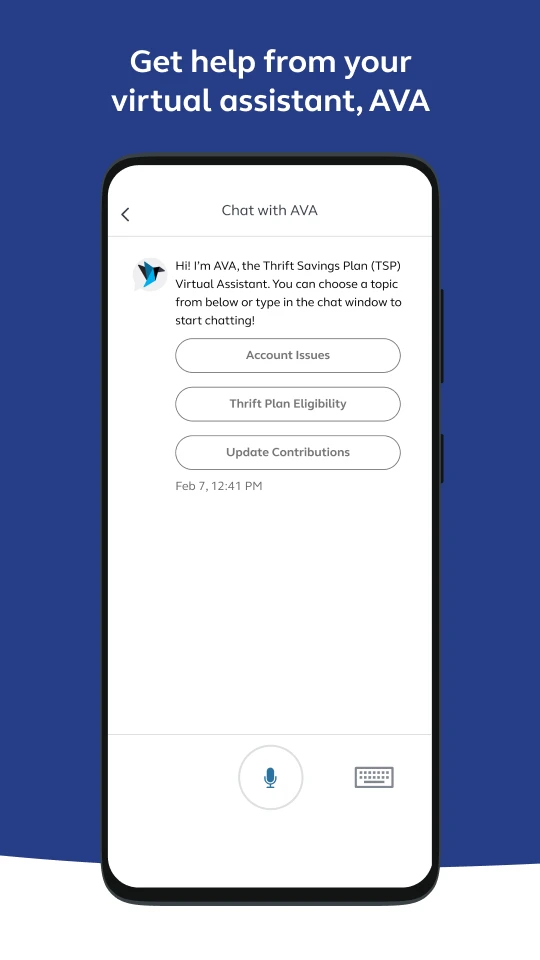

Q: Can I use the TSP app on my phone or tablet?

A: Yes, many government personnel access their TSP data through a mobile-friendly website or a dedicated mobile app, providing secure access to account balances and statements, though some full features might be accessed via the desktop website.

Q: When transferring my retirement savings from another government job, how long does it take?

A: Initial transfers via the Federal Employee Retirement System (FERS) or Standard Form 3105 might require processing time, typically one to three weeks, depending on the complexity of the transfer source and agency regulations.

Q: Is there a minimum amount I need to have in my TSP account to do anything?

A: Generally, there’s no minimum balance requirement to hold funds or open an account within the Thrift Savings Plan. You can still manage core functions like making contributions (subject to limits) or viewing your balance even with a very small account value.

|

|

|

|