Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

|

|

| Rating: 4.1 | Downloads: 5,000,000+ |

| Category: Finance | Offer by: Green Dot |

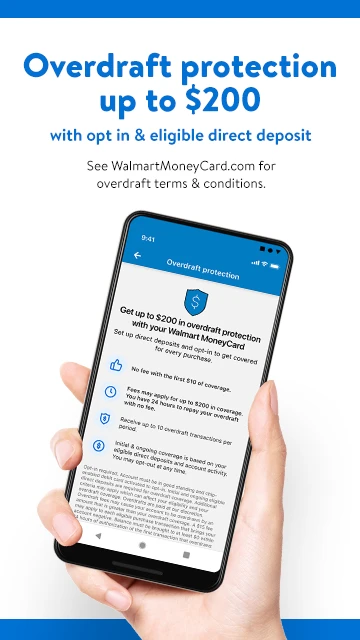

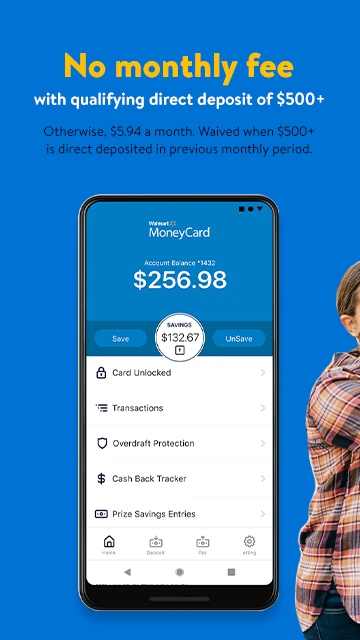

The Walmart MoneyCard app is your digital wallet powered by Walmart, designed for users who prefer cash-like spending options. It allows you to make purchases, pay bills, and manage your funds directly from your smartphone, offering a convenient alternative to traditional bank accounts or physical cards. Whether you’re a student, someone building credit, or managing a household budget, the Walmart MoneyCard provides accessible financial tools tailored for everyday needs.

The key appeal lies in its simplicity and integration with Walmart services. It offers an easy way to build credit history, make secure payments online and in-store (via compatible retailers), and access your funds without needing direct bank account details. For practical usage, it’s ideal for quick, everyday transactions, online shopping with major retailers, and managing your finances on the go, making budgeting and payments more streamlined.

| App Name | Highlights |

|---|---|

| Chime Credit Builder |

This app helps build credit quickly with a secured line of credit and offers features like early direct deposits. Known for its user-friendly interface and transparent fee structure focused on helping users establish credit history. |

| PayPal Credit |

Offers interest-free financing for purchases and bill payments with a simple online account. Includes automatic payment options and is widely accepted online and over 20 million in-store locations, providing convenience for everyday spending. |

| Discover Cash Back |

An app designed for users wanting to earn rewards while building credit. Offers a flexible payment plan system and robust account management tools to track spending and improve credit scores effectively. |

Q: How quickly can I get approved for a new line of credit on the Walmart MoneyCard app?

A: Approval for a new line of credit can often be completed within minutes, sometimes even instantly, depending on the information provided and your creditworthiness. The app provides immediate feedback on approval status, making the process efficient.

Q: What is the minimum credit score required to get approved for the Walmart MoneyCard?

A: While there isn’t one single fixed score requirement, the general expectation is that most applicants have a credit score of at least 600. However, factors like income and debt-to-income ratio also play a significant role in the approval decision.

Q: Can I use the Walmart MoneyCard for online shopping with small retailers?

A: Yes, the Walmart MoneyCard (Visa or Mastercard) is accepted by thousands of online retailers nationwide. You can check the retailer’s website to confirm acceptance or use the app’s built-in feature to find participating stores for in-store purchases.

Q: Are there any fees associated with the Walmart MoneyCard besides interest on the outstanding balance?

A: Apart from potential interest charges, common fees may include an annual fee (though often waived initially or with good standing), late payment fees, and possibly a foreign transaction fee if used internationally. It’s best to review the app’s fee schedule for specifics.

Q: How do I dispute a transaction on my Walmart MoneyCard statement through the app?

A: You can dispute transactions directly within the app. Simply go to your transaction history, select the disputed item, and follow the prompts to file a dispute. The process uses secure channels and is designed to be user-friendly, typically initiating an official inquiry with the issuing bank.

|

|

|

|